What process do I follow to enforce my right to a high-value heirloom left in a will? – North Carolina

Short Answer

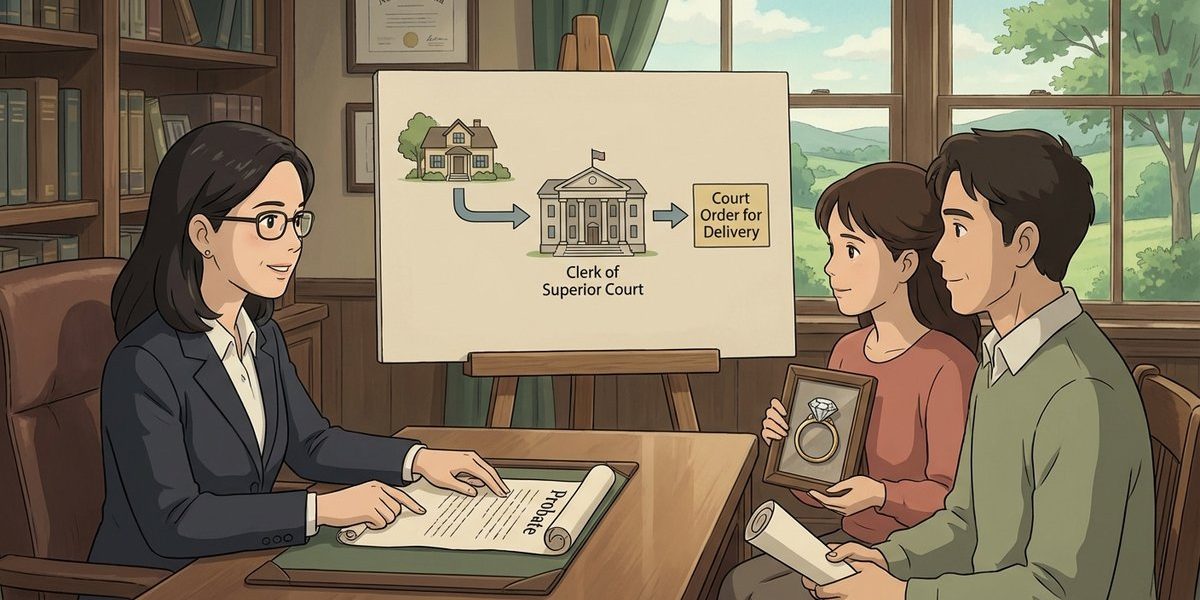

In North Carolina, the usual way to enforce a right to a specific heirloom left in a will (like a diamond ring) is to work through the estate administration in front of the Clerk of Superior Court in the county where the decedent lived. If the personal representative (often called the executor) refuses to deliver the item, an interested beneficiary can request court involvement through an estate proceeding so the Clerk can order proper administration and delivery. Because the beneficiary lives out of state, the process often focuses on documented demand, proof of the gift in the will, and a court order that sets safe transfer terms rather than in-person pickup.

Understanding the Problem

In North Carolina probate, the key question is: when a will leaves a specific item of personal property (a high-value heirloom such as a diamond ring) to a named beneficiary, what process can be used to require the executor to turn it over when the executor refuses to release it or arrange safe delivery. The situation often comes up when the executor controls access to the decedent’s belongings, the beneficiary lives in another state, and the executor will not ship or insure the item. The focus is enforcing delivery through the estate’s court-supervised administration rather than informal family arrangements.

Apply the Law

North Carolina treats the executor/personal representative as a fiduciary who must gather, safeguard, and distribute estate property according to the will and the estate administration rules overseen by the Clerk of Superior Court. A beneficiary generally enforces a right to a specific bequest by confirming the will has been properly probated and then using the estate file to request relief from the Clerk if the personal representative will not perform required duties. If the dispute involves whether the will controls the item, whether the item is part of the estate, or whether another statutory claim takes priority, the Clerk may require a formal contested estate proceeding with service and a hearing.

Key Requirements

- A valid, probated will that makes the gift: The will generally must be admitted to probate so it is effective to pass title to personal property and to guide the executor’s duties.

- Standing as an “interested person” and a clear request for relief: The beneficiary must be able to show a direct interest under the will and ask the Clerk for an order that addresses the executor’s refusal to deliver the specific item.

- Proper procedure (filing, service, and a hearing if contested): When the executor disputes the request or refuses to act, the beneficiary typically must proceed through an estate proceeding that includes a verified filing, issuance of an estate summons, service under Rule 4, and a scheduled hearing before the Clerk.

What the Statutes Say

- N.C. Gen. Stat. § 31-39 (Probate necessary to pass title) – Explains that a duly probated will is effective to pass title to real and personal property and includes a time limitation concept that can matter if probate is delayed.

- N.C. Gen. Stat. § 30-19 (Property awarded to surviving spouse and children) – Provides that the Clerk determines what personal property is awarded for statutory allowances, which can affect what personal property is available for distribution under a will.

- N.C. Gen. Stat. § 30-20 (Procedure for assignment; order of clerk) – Describes the Clerk’s order-based process for allowances and how the Clerk may direct a contested estate proceeding if a hearing is needed.

- N.C. Gen. Stat. § 31C-5 (Perfection of title; duty after written demand) – In certain situations involving property held by a surviving spouse at death, allows an action to perfect title and notes the personal representative’s duty can be triggered by a written demand from an heir or devisee.

Analysis

Apply the Rule to the Facts: The facts describe a beneficiary named in a will who cannot retrieve a specific, high-value item (a diamond ring) because the executor refuses to ship or insure it. Under North Carolina practice, the first checkpoint is whether the will has been admitted to probate in the proper county, because probate is what makes the will operative to pass title to personal property and gives the executor authority and duties. If probate is open and the ring is estate property, the beneficiary typically enforces delivery by making a documented demand and, if the executor still refuses, asking the Clerk of Superior Court for an order in the estate file (often through a contested estate proceeding if the executor disputes the request).

Process & Timing

- Who files: The beneficiary/devisee named to receive the heirloom (or counsel on that person’s behalf). Where: The Clerk of Superior Court in the county where the decedent was domiciled (the estate file is kept there). What: A written demand to the personal representative for delivery of the specific bequest, followed (if needed) by a verified petition in an estate proceeding requesting an order compelling the personal representative to deliver the item or to follow a court-approved transfer method. When: As soon as it becomes clear the executor will not voluntarily comply; delays can create practical problems, and probate timing can matter if the will has not been offered for probate.

- Service and scheduling: If the matter is contested, the process typically requires issuance of an estate proceeding summons and service under Rule 4 on the executor and other required interested persons, then scheduling a hearing before the Clerk with notice to the parties.

- Hearing and order: At the hearing, the beneficiary generally presents the will provision, proof the item is estate property, proof of refusal, and a reasonable proposed method of transfer (for example, delivery to counsel, delivery to a neutral third party, or shipment using defined packing/insurance/signature requirements). If the Clerk grants relief, the Clerk enters a written order directing the executor’s next steps.

Exceptions & Pitfalls

- Statutory allowances can change what property is available: Even when a will leaves a specific item, North Carolina’s spouse and child allowance process can require the Clerk to award certain personal property first, which may create a dispute about whether the ring must be used to satisfy an allowance.

- “It’s not an estate asset” defenses: The executor may claim the ring was gifted before death, jointly owned, or otherwise not part of the estate. These disputes often require evidence and may push the matter into a more formal contested estate proceeding.

- Procedure mistakes: Filing the wrong type of request, failing to verify the petition when required, or failing to properly serve all required interested persons can delay a hearing and reduce leverage.

- Out-of-state beneficiary logistics: A refusal to ship is common. A practical request often asks the Clerk to order a secure transfer method (documented chain of custody, insurance, signature requirements, or delivery to a designated agent) rather than relying on informal shipping promises.

- Appeal timing: If the Clerk enters an order in an estate matter, an aggrieved party may have a short deadline to appeal to Superior Court, so the date the order is received matters.

Conclusion

In North Carolina, enforcing a right to a high-value heirloom left in a will usually happens through the estate administration before the Clerk of Superior Court in the county where the decedent lived. The beneficiary generally must confirm the will is probated, make a clear written demand for delivery of the specific item, and—if the executor refuses—file a verified estate petition requesting an order compelling delivery and setting a safe transfer method. The most important next step is to file the requested estate proceeding with the Clerk of Superior Court promptly after refusal.

Talk to a Probate Attorney

If a beneficiary cannot obtain a specific heirloom left in a North Carolina will and the executor refuses to release or ship the item, our firm has experienced attorneys who can help explain the probate process, prepare the right filings, and track deadlines. Call us today at (919) 341-7055.

Disclaimer: This article provides general information about North Carolina law based on the single question stated above. It is not legal advice for your specific situation and does not create an attorney-client relationship. Laws, procedures, and local practice can change and may vary by county. If you have a deadline, act promptly and speak with a licensed North Carolina attorney.