Do the investment accounts that are payable on death to a testamentary trust have to be retitled into the trust first before any beneficiaries can receive their outright shares? – North Carolina

Short Answer

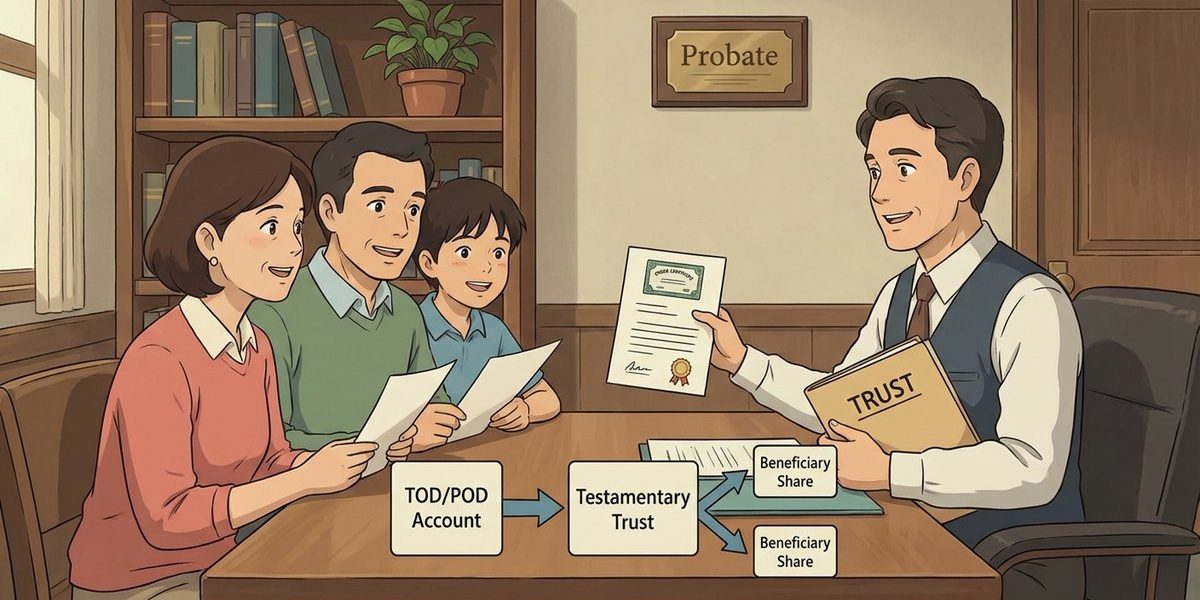

Usually, yes in practice: if a brokerage account is designated TOD/POD to a testamentary trust, the brokerage typically will not distribute “outright shares” directly to the children until the account is transferred into an account titled in the name of the trustee of that testamentary trust (or otherwise placed under the trustee’s control). Under North Carolina law, a TOD/POD designation controls who becomes the owner at death, and if the trust is the named beneficiary, the trust (through its trustee) becomes the owner. After the trustee receives and controls the assets, the trustee can then make the outright distributions required by the will and fund any continuing sub-trusts.

Understanding the Problem

In North Carolina probate administration, the key question is: when an investment account is marked “transfer on death” or “payable on death” to a testamentary trust created by a will, can the brokerage skip the trust and pay certain children their outright shares directly. This issue comes up when a will splits assets so that some beneficiaries receive immediate distributions while other beneficiaries’ shares stay in trust, and the family is also deciding whether to keep the same brokerage/trust provider or move the trust administration to a different corporate trustee.

Apply the Law

North Carolina recognizes TOD/POD registrations for securities accounts. The TOD/POD designation is a contract-style transfer that becomes effective at death and is not controlled by the will’s general probate transfer rules. If the named TOD beneficiary is a trust, the trust (acting through its trustee) is the recipient/owner after death. That structure matters because the trustee is the person with legal authority to receive the account, open a trust account, and then distribute the assets according to the will’s trust terms (including making outright distributions and funding separate sub-trusts).

Key Requirements

- Correct beneficiary designation: The account must be registered in beneficiary form (often shown as “TOD” or “POD”) naming the testamentary trust (or its trustee) as the beneficiary.

- A trustee with authority to act: A trustee must be identified/appointed under the will (and able to prove authority) so the brokerage has someone who can accept title/control of the account for the trust.

- Distributions follow the trust terms: Once the trust receives the assets, the trustee distributes outright shares and funds continuing sub-trusts as the will directs, after handling any required administration steps.

What the Statutes Say

- N.C. Gen. Stat. § 41-44 (TOD/POD registration form) – Explains how a security can be registered in beneficiary form using “TOD” or “POD.”

- N.C. Gen. Stat. § 41-45 (Effect of TOD registration) – Provides that the TOD designation does not change ownership until death.

- N.C. Gen. Stat. § 41-48 (TOD transfer is nontestamentary; estate-debt exposure) – States the TOD transfer is not testamentary and also addresses potential liability for estate debts if the estate is insufficient.

Analysis

Apply the Rule to the Facts: Here, the account is payable on death to a testamentary trust that will (1) distribute some shares outright to certain children and (2) hold other shares in separate sub-trusts. Because the trust is the named TOD/POD recipient, the brokerage generally treats the trust (through its trustee) as the party entitled to receive the account at death, not the individual children. That usually means the account must first be transferred into a trust-titled account under the trustee’s control, and then the trustee makes the required outright distributions and funds the sub-trusts.

Process & Timing

- Who files: The acting trustee named in the will (or the person seeking to be recognized as trustee). Where: Typically with the brokerage’s decedent/TOD transfer department; and, as needed, with the Clerk of Superior Court (Estates) in the county where the estate is administered. What: Proof of death, the will and any trustee appointment/qualification documents the institution requires, and the brokerage’s TOD claim/transfer paperwork. When: As soon as the trustee can document authority; timing varies by institution and whether the trustee appointment is clear.

- Retitle/transfer step: The brokerage commonly opens (or re-registers into) an account titled to the trustee of the testamentary trust, then transfers the TOD assets into that trust account so the trustee can administer and allocate shares.

- Distribution step: After the trustee has control, the trustee can distribute the “outright” shares to the children and transfer the remaining shares into the separate sub-trust accounts required by the will (or into appropriately titled accounts for each sub-trust).

Exceptions & Pitfalls

- Brokerage operational limits: Even if the will clearly calls for some children to receive outright shares, a brokerage usually will not “look through” a trust beneficiary designation and pay individuals directly without the trustee receiving the assets first.

- Unclear trust identification: If the TOD designation does not clearly identify the testamentary trust (or the trustee), the brokerage may treat the designation as defective and require probate involvement or additional documentation.

- Multiple beneficiaries vs. one trust beneficiary: If the account names multiple individual TOD beneficiaries, the institution may split directly among them. But when the named beneficiary is a single trust, the institution typically pays the trust as the single beneficiary, and the trustee handles the internal split.

- Estate-debt “pull back” risk: North Carolina law allows certain non-probate transfers to remain reachable for estate debts if the probate estate cannot cover valid claims. That risk can affect how quickly a trustee should make outright distributions.

- Changing trustees/providers midstream: Moving to a different corporate trustee may require additional retitling steps (and sometimes transfer/closing fees) before distributions can be made. See fees to transfer or close out accounts.

Conclusion

In North Carolina, a TOD/POD investment account passes at death to the named beneficiary, and if the beneficiary is a testamentary trust, the trustee is the person who must receive and control the account before the trust’s terms can be carried out. As a result, the account typically needs to be transferred into a trust-titled account first, and then the trustee can distribute the required outright shares and fund the separate sub-trusts. The practical next step is to submit the brokerage’s TOD claim package so the account can be transferred into the trustee’s name for the testamentary trust.

Talk to a Probate Attorney

If a TOD/POD brokerage account is supposed to fund a North Carolina testamentary trust and the family is trying to make outright distributions while also considering a trustee change, our firm has experienced attorneys who can help clarify the steps, paperwork, and timing. Call us today at [919-341-7055].

Disclaimer: This article provides general information about North Carolina law based on the single question stated above. It is not legal advice for your specific situation and does not create an attorney-client relationship. Laws, procedures, and local practice can change and may vary by county. If you have a deadline, act promptly and speak with a licensed North Carolina attorney.